Congratulations! You have Job Hacked your way out of debt and now have an ever-growing pile of cash that you need to put to work so it can grow and ultimately allow you to reach your FIRE goals. However, this brings up its own questions and concerns. Should I just stick all this extra cash in the bank, or a CD, or bonds? Should I invest in real estate? What about the stock market? Some combination of all of the above?

Don’t get me wrong, this is a very good problem to have, but still it can be stressful. The good news is there is no true right or wrong answer here and it very much depends on your own personal situation, knowledge, and risk tolerance. What follows is not specific financial advice or guidance and instead is simply my own personal experiences investing real money (six figure range) into various investment vehicles so that you can see and judge for yourself how well or not these specific investment strategies have panned out in real life.

Before beginning if you have not read Rich Dad Poor Dad by Robert Kiyosaki and The Little Book that Beats the Market by Joel Greenblatt, where he coined the phrase “Magic Formula Investing”, then I highly recommend you read both as they are excellent books in general and also explain some concepts below in much great detail then I can cover in a short blog post. Of course, if you have specific comments or questions don’t hesitate to reach out and I am more than happy to elaborate in more detail in the post or comments as needed. Without further preamble lets talk about my experience over the last roughly 1.5 years investing in stocks via two very different strategies.

Magic Formula Investing

Magic Formula Investing method in a nutshell is a method that looks for “value” stocks or stocks that for whatever reason have a relatively low price to earnings ratio among other metrics. Joel makes the process easier by providing a website where you can login and obtain a list of stocks that his magic formula has identified has potential “value” stocks based on current price and most recent quarterly financial results. What you will typically find on these lists are stocks that have come under intense selling pressure for a variety of reasons thus make them cheap compared to other similar companies and their own historical performance. Your goal as investor then is to try to find the ones that are fundamentally sound and will hopefully be recognized as such by the market within a reasonable amount of time so that you can be rewarded financially when the market catches up and begins driving the price of these under valued stocks back up. There are also some guidelines given in the book about how long to hold winners (more than 1 year) and losers (less than 1 year) to minimize tax implications when investing with this method. The book is very compelling and Joel provides some excellent analysis of his method’s performance verses historical data. However, he also caveats that even his method can lose money and even when applying his method to historical data there are some years where it shows a loss, but over a longer time period >10 years his method showed a much higher performance than the market average when using historical data. Finally, the other key factor or risk in this method is that in the end it is a stock picking and timing method. You are given some guidance in the form of the formula’s hand-picked list of “value” priced stocks, but ultimately you the investor must then take that list and try to pick the “winners”. So what follows will show you how well (or not) I have done trying to put this method into practice over the last 1.5 years.

Realized Gains and Losses

First, I will share the realized gains and losses on a stock by stock basis and then overall for the portfolio. I won’t share absolute numbers but percentages so you can get a feel for the trend of each transaction and of course to a certain point this could be scaled across a range of different investment levels from $100 per stock to $100,000 or even more. All fees, transaction costs, as well as any dividends or positive stock actions (merger and awarding of cash and stock in new company) have also been included in the final percentages to give the most realistic view of the performance as possible. Finally, the amount invested in each individual stock was not equal so this also accounts for some of the variability in this process as well.

Vanguard

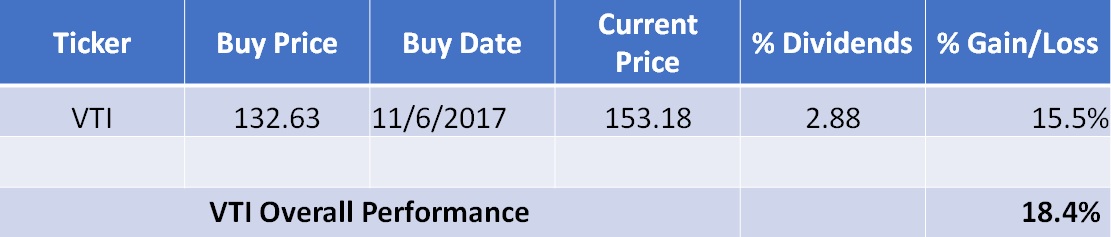

On the exact same day (11/06/2017) that I started the Magic Formula Investing experiment I also invested a comparable amount of capital directly into Vanguard’s Total Stock Market ETF (VTI). Vanguard’s VTI ETF is a fund that simply aims to track the broader stock market by purchasing a large basket of stocks across the broader US market including small, mid-size, and large companies. This is a passively managed fund and has one of the lowest expense ratios of any fund available on the market today. In this case I have simply held onto the VTI shares and reinvested all received dividends. Therefore, the analysis below is technically speaking Unrealized Gains, but as of this writing if I were to sell these shares now this is what the total resulting performance would look like.

Conclusion

First and most importantly it is nice to see that both methods resulted in positive and reasonable capital growth overall. The Magic Formula resulted in a 4.8% annualized rate of return and VTI 11.0%, respectively. Not spectacular but outpacing inflation and much better than current bank or CD savings rates. In my specific case over the last approximately 1.5 years the Vanguard VTI has hands down out performed my application of the Magic Formula Investing Method. Personally, I still really like the ideas and fundamentals behind the Magic Formula Investing approach but based on these results I will need to get better at selecting, timing, and weighting my acquisitions in this system if I want to be able to outperform the current VTI ETF funds performance. I hope this helps information and analysis is useful and would love to hear from anyone else out there that has tested these or other methods and what your experience has been.

2 Replies to “Magic Formula Investing vs Vanguard ETF”